In the banking industry, compliance and risk management are of utmost importance. Banks face stringent regulatory requirements and must implement robust controls to ensure legal and ethical practices. In the era of big data, banks must employ advanced technologies and platforms to manage compliance and mitigate risks effectively. Live Earth, a leading provider of data solutions, offers a comprehensive data platform that empowers banks to enhance compliance, streamline risk controls, and drive banking excellence. Let’s explore how banks use the Live Earth Data Platform to strengthen their compliance frameworks, improve risk management, and achieve sustainable success.

Understanding the Live Earth Data Platform

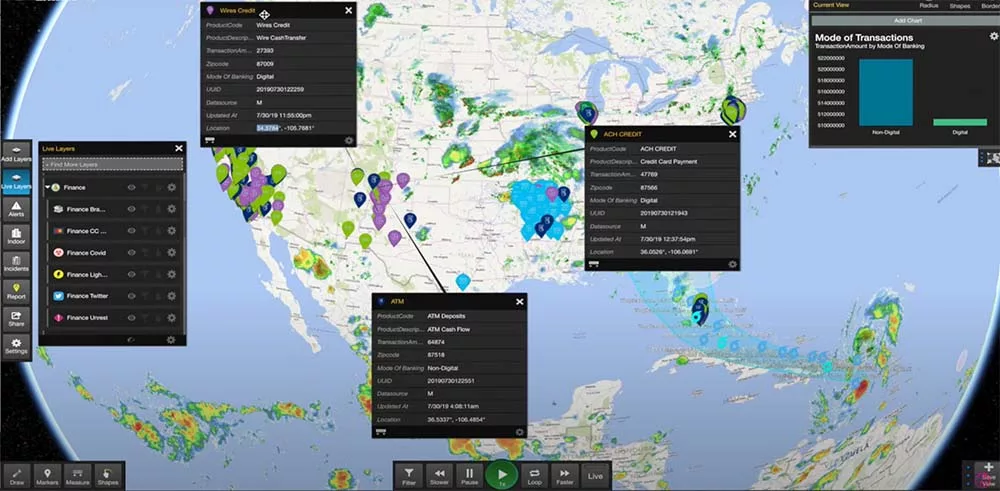

The Live Earth Data Platform for Compliance is a cutting-edge solution designed to harness the power of data in the banking sector. It helps banks aggregate, analyze, and visualize extensive data from various sources, offering a comprehensive compliance and risk view. By integrating data from internal systems, third-party sources, and regulatory databases, the Live Earth Data Platform offers a comprehensive and real-time understanding of compliance requirements and potential risks.

Enhancing Compliance with the Live Earth Data Platform

- Regulatory Monitoring and Reporting: Live Earth empowers banks to monitor and stay updated on regulatory changes. By integrating regulatory data feeds, banks receive real-time alerts, ensuring compliance with evolving regulations. The platform also facilitates automated reporting, streamlining the process and reducing manual errors.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Compliance with AML and KYC regulations is critical for banks. The Live Earth Data Platform provides advanced analytics capabilities to identify and flag suspicious transactions, enabling banks to enhance AML controls. Also, by integrating customer data from various sources, the platform strengthens KYC processes, ensuring compliance and reducing financial crime risk.

- Data Privacy and Protection: Data privacy is a top concern for banks. The Live Earth Data Platform includes robust data privacy and protection features, enabling banks to securely manage sensitive customer information. By implementing encryption, access controls, and data anonymization techniques, banks can comply with data protection regulations and safeguard customer trust.

Streamlining Risk Controls with the Live Earth Data Platform

- Risk Data Aggregation and Analysis: It enables banks to aggregate risk-related data from various sources, including internal systems and external market data. This comprehensive view of risks facilitates better risk assessment, scenario analysis, and stress testing. Banks identify potential vulnerabilities, proactively manage risks, and make informed decisions.

- Fraud Detection and Prevention: By leveraging advanced analytics and machine learning algorithms, banks detect patterns and anomalies indicative of fraudulent activities. Furthermore, by analyzing transactional data, customer behavior, and external risk indicators, they strengthen fraud detection capabilities and minimize financial losses.

- Operational Risk Management: Helps banks identify and reduce operational risks. Through operational data analysis, risk indicator tracking, and process efficiency monitoring, banks optimize operations, minimize errors, and improve risk control.

Driving Banking Excellence with the Live Earth Data Platform

- Improved Decision-Making: The platform provides banks with real-time insights and analytics, enabling informed decision-making. By visualizing complex data sets, banks identify trends, assess risks, and seize opportunities promptly. This data-driven decision-making approach enhances operational efficiency and drives banking excellence.

- Enhanced Compliance Culture: It promotes a culture of compliance within banks by providing tools for monitoring, reporting, and documentation. By streamlining compliance processes and increasing transparency, the platform fosters a strong compliance culture and minimizes regulatory risks.

- Cost Efficiency: Helps banks optimize resource allocation and reduce operational costs. Through automated compliance and risk monitoring, banks streamline processes, enabling efficient resource allocation and freeing personnel for higher-value tasks. This cost-efficient approach contributes to overall profitability and sustainable growth.

Embrace the power of the Live Earth Data Platform to transform your bank’s compliance and risk management practices. Leverage advanced analytics, real-time insights, and comprehensive data aggregation to enhance compliance frameworks, streamline risk controls, and drive banking excellence. Learn how Live Earth can help achieve compliance, mitigate risks, and position your bank for success in an evolving industry. Contact us to schedule a call today!