Did you know the use of data analytics is changing the face of the insurance industry, as well as other businesses? Analytics are also utilized to identify troublesome claims that may result in losses for a business. Additionally, they play a crucial role in insuring people against natural disasters such as floods, earthquakes, and more.

Businesses want to get back to normalcy and be effective as soon as possible after a natural event. Minimizing the damage from natural disasters helps companies recover more quickly, avoiding a crisis from service interruptions. The key is in planning beforehand, and predictive analytics may be the answer.

Predictive Analytics

Predictive analytics is the future of insurance, as the use of artificial intelligence has entered the scene. Furthermore, it could be the answer to reducing underwriting expense issues. Collecting data from multiple sources ensures better prediction and understanding.

Some Uses of Analytics

Accessing data and feedback directly from smart devices, social media, and interactions between claims specialists and customers at the source, rather than relying on traditional sources like credit history or criminal records, provides valuable insights for pricing and risk selection. This approach enhances accuracy and offers a more comprehensive understanding of customer behaviors and preferences.

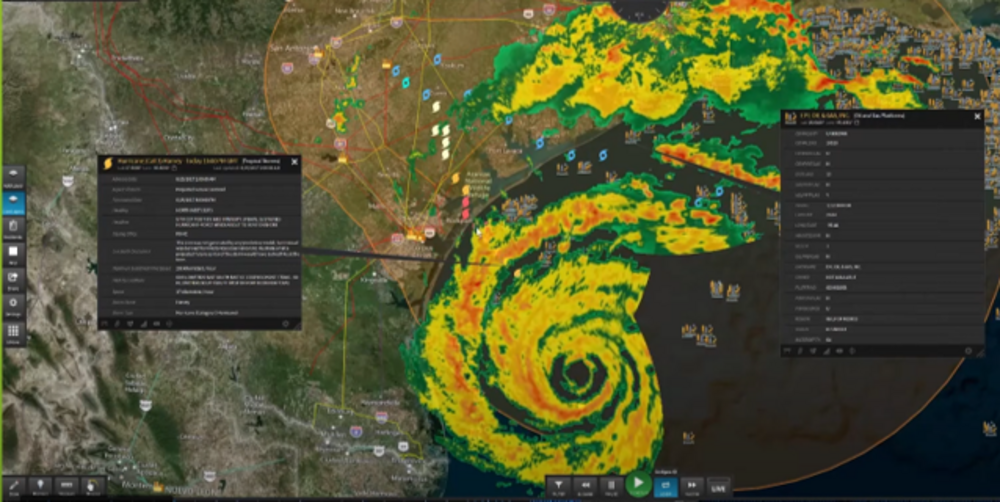

Real-Time Information

Predictive planning and historical information provides an accurate picture of the number of resources needed to cover the amount of anticipated work. Following a natural disaster, restoration teams quickly assess affected customers and initiate work, providing peace of mind and enabling a faster recovery process.

Customers at Risk of Cancellation

In the realm of insurance, predictive analytics can effectively identify customers who may be inclined to cancel their policy or seek lower coverage. Insurers can proactively recognize those who might express dissatisfaction with their insurer or coverage. This enables them to establish a personal connection and address any potential concerns promptly and effectively. After a natural disaster, restoration teams swiftly assess customers who have been affected and initiate the necessary work, offering peace of mind and facilitating a quicker recovery process.

Fraudulent Claims

Did you know that insurance fraud makes up approximately 10% of claims costs for the industry? Predictive analytics may spot fraud before it happens through the use data sources including social media. Following a natural disaster, restoration teams promptly assess affected customers and take immediate action to initiate the necessary work, providing peace of mind and facilitating a faster recovery process.

Customer Loyalty

Companies can use predictive analytics to anticipate the needs of their customers while seeing their history. Brand loyalty is important when a company wants to keep its customer from turning to a competitor.

After a natural disaster, restoration teams act promptly to assess affected customers and initiate necessary work. They provide peace of mind while facilitating a faster recovery process. With expanded global markets and social media interactions, much is now accessible.

Contact us today to learn more about how Live Earth can empower you with predictive analytics, providing the assurance you need. Gain a competitive advantage, minimize losses, and expand your view of risk events through our advanced predictive modeling and artificial intelligence. Don’t miss out on the opportunity to enhance your risk management strategies and make informed decisions with confidence.