Business leaders rely on financial analysis and forecasting to guide decision-making at their companies. Without insightful analysis and accurate forecasting, teams cannot fully grasp how their companies are performing and what next steps they should take.

Unfortunately, factors like the significant time investment required for manual analysis and disconnected systems prevent companies from producing the financial analysis and forecasting they need. The right tools can change that, though.

Business intelligence (BI) solutions have applications across departments and business areas — including finance. Let’s explore some of the specific BI applications in finance, plus the advantages of using this software.

BI applications in finance

Financial forecasting

Despite the importance of accurate financial forecasting, many companies operate off of inaccurate forecasts. In fact, these forecasts are wrong more often than they’re right. So if you’re basing business decisions on inaccurate forecasts, those decisions are much less likely to benefit your company.

Luckily, the built-in forecasting tools within BI software help teams develop more accurate financial forecasts. Teams can pull together all of their financial data from various sources and analyze it collectively. Looking at all this data in one place makes the forecasts you create more reliable.

Many BI solutions also allow you to use real-time data, further improving forecasts. Instead of using only historical data to create your forecasts, use the most up-to-date data also for greater accuracy.

Risk management

Part of leading a company to success is anticipating and reacting to possible threats. Financially, companies face various risks they must manage — from credit to market risks.

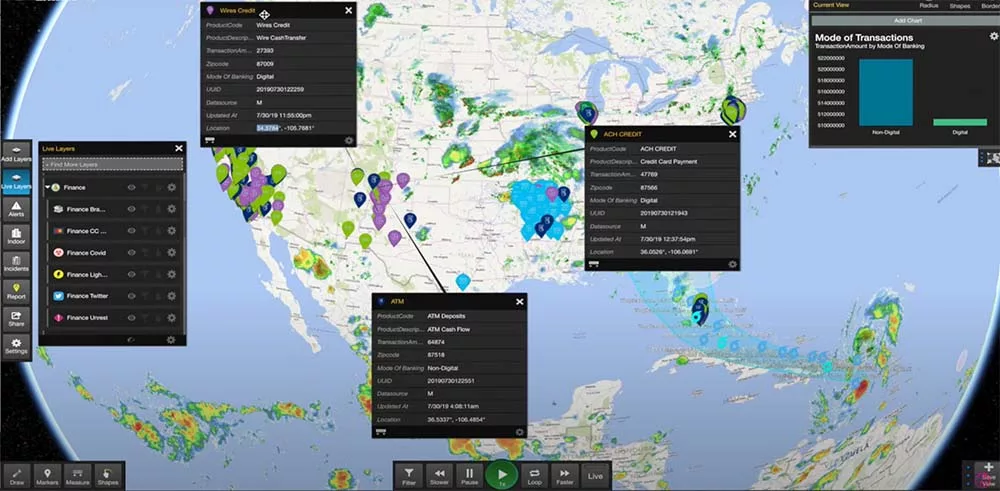

Business leaders can use BI tools to identify and address financial threats to their companies. Dashboards within these tools make it easy to monitor financial performance and possible threats at a glance. Customize your dashboards to display metrics most important to your company’s risk management, so you always know what’s happening.

Detecting and addressing threats as soon as possible greatly improves your risk management. You won’t have to wonder what issues threaten your company’s success — you’ll know. From there, you can resolve those threats before they financially strain your enterprise.

Financial reporting

Manual financial reporting is one of the most time-consuming, tedious tasks a company can take on. Rather than wasting your team’s time copying and pasting data — and likely making some errors — why not use BI software to improve reporting?

The BI system will sort out bad data from your various data sets to ensure only necessary, high-quality data goes into your reports. Your team can then use the software to create accurate, useful financial reports with just a few clicks. No more slaving over spreadsheet after spreadsheet.

Since many BI solutions include data visualization tools, you can even include eye-catching graphics in these reports. The reports you create with the BI tool will be well-structured and ready to send to internal and external stakeholders alike.

Advantages of using BI for financial analysis

Those are just a few of the top applications of business intelligence solutions in finance. Regardless of your precise applications, using BI software for financial analysis yields several benefits, including the following:

Improve productivity

Having your data team manually sort through and analyze your company’s data is inefficient. Relying instead on BI tools will boost your data team’s productivity. They’ll be able to easily analyze your financial data, generate reports, and share information with other team members.

Using business intelligence solutions also makes it easier to locate the data you need when you need it. Instead of digging through multiple systems and databases for specific information, you’ll find all your data in one place.

Data democratization

It’s one thing for your data team and top leadership to engage with your company’s financial analysis and forecasts. Ideally, though, wider groups within your organization could offer their thoughts, engage with the data, and point out additional insights. They often aren’t able to because data analysis and review are isolated to specialized professionals. BI software changes that.

The reports your team can create with BI tools simplify complex data. Large, complicated data sets become accessible, engaging reports your whole team can use. Data visualizations like charts and graphs allow anyone to interpret and work with the data regardless of their training.

Reduce risk

Mitigating risk is a difficult task that all companies must tackle, but business intelligence solutions can help. Use the BI software to track financial behavior, employee behavior, and even external data to predict threats to your company. As a result, you can reduce your company’s overall risk level by noticing and addressing these potential risks faster.

Increase profitability

In-depth financial analysis can yield many valuable insights, including your company’s current profitability and opportunities for improvement. Specifically, looking at metrics like customer lifetime value may help guide your plans to increase profitability. This financial analysis will tell you what’s working and what’s not so you can refocus your efforts.

Use BI tools to complete a comprehensive analysis of your company’s pricing, promotions, and new products, for example. Track your profitability over time and gauge how well you’re meeting your financial targets.

Gain a competitive edge

While other companies rely on outdated data practices and isolated analysis tools, your company can gain a competitive advantage. Using BI software allows you to create more accurate forecasts and complete more insightful analyses — driving your company forward.

The real-time data features alone in these tools will help you make better data-driven decisions compared to competitors. Any productivity gains or greater accuracy you get from using the software will foster a competitive edge.

Final thoughts

Business intelligence solutions are game-changing tools in financial analysis and forecasting. For reliable, accurate forecasts and valuable analysis, there’s no better option than business intelligence software like Live Earth. As a real-time data streaming and analysis platform, Live Earth gives business leaders unrivaled control and insights into their data. Contact us to see Live Earth in action and learn more about the ways you can use BI software to benefit your business.