In 2023, businesses across industries from healthcare to education to financial services will contend with the effects of the current digital transformation. The digital transformation in banking, specifically, requires financial institutions to make fundamental changes in the way they operate.

New developments like AI tools, the rise of cryptocurrencies, and even the metaverse represent some of the transformational forces in the industry. As many leaders of financial institutions realize, they cannot simply dig their heels in the sand and ignore these developments. To succeed today and going forward, they need to embrace the digital transformation and prepare for the future of banking.

An effective digital transformation strategy must weigh many factors and involve several different components. At the core of these strategies, however, is a focus on the customer. It’s about answering the question — How can you use digital tools and solutions to satisfy your customers? Banking data solutions offer many benefits you can use to improve customer loyalty at your financial institution. In this article, we’ll break them down.

Achieving a 360-degree view of the customer

It’s one thing to understand some of your customers’ needs. It’s another to have a complete 360-degree view of your customers that you can use to meet those needs. Banking data solutions can help you achieve the latter.

Having a 360-degree view of your customer means keeping track of all their interactions in one place. This includes basic personal information as well as any interactions they’ve had with your customer service team, past and present purchasing data, their activity on your website, and even their social media activity. Unfortunately, in many financial institutions, this data is kept in various data silos that only specific departments can access.

Banking data solutions integrates all this data, eliminates data silos, and offers a complete view of your customers in one place. Being able to look at this 360-degree customer view helps you develop a more effective customer management strategy. You’ll also facilitate collaboration between departments, making it easier to jump on possible up-sell or cross-sell opportunities as they arise.

Creating intuitive and custom banking solutions

Financial customers today aren’t interested in general banking products. Instead, the modern banking customer wants custom banking solutions that fit their unique needs. Your products should be personalized to save customers time and seamlessly recognize their preferences. At first, it may seem impossible to create custom products that will keep each one of your many customers happy, but data analysis makes it possible.

With the help of modern banking solutions, utilizing the data you collect about each of your customers to create a more personalized banking experience. Personalization keeps your customers happy and offers your financial institution several benefits, including higher engagement and revenue.

It’s not enough to simply offer custom banking products, though. To increase customer loyalty, these products also need to be easily accessible and intuitive for customers to use. You can use your data to find and address areas of your products that pose challenges to your customers. Failing to create personalized, intuitive solutions could drive your customers to competitors who do offer these features.

Financial education resources and tools

A key issue for many financial customers is improving their financial literacy. Financial customers today want to better understand the range of solutions and options available to them, including how products like mortgages and certificates of deposit work.

Financial institutions can use banking data solutions to develop the educational resources and tools their customers want. If you can deliver the resources your customers need at the right time, you’ll build trust and a stronger connection with them. Customer data offers insights into the questions and concerns your customers have about financial products so you can develop the right resources to address those points.

Automated customer service solutions

Providing quality customer service to your customers is key to ensuring they stick with your financial institution and don’t head to your competitors. The challenge for many banks (and other industries) is that consistently delivering a high level of customer service isn’t easy. It’s expensive and time-consuming and can go wrong in many different ways. Luckily, some banking data solutions include automated customer service features to address these issues.

Artificial intelligence (AI) customer service solutions can enhance — not replace — the existing customer service that your financial institution offers. These solutions can take in and process large volumes of customer data to better respond to customer service requests. They also are available 24/7, removing the worry about service downtime or hiring staff to work around the clock.

AI chatbots can answer your customers’ basic service requests and questions at the touch of a button. For more complicated requests, automated customer solutions can seamlessly direct the request to the appropriate service professional. This technology can even analyze customer messages for things like tone and key phrases to better tailor the response.

Banking Data Solutions for the Modern Financial Institution

Financial institutions looking to embrace the digital transformation in banking need strong banking data solutions. With the right tools, they can greatly increase customer loyalty by redefining the customer experience and offering the custom banking solutions modern customers want. Increasing customer loyalty to your financial institution will drive revenue growth, keeping you ahead of the competition in this changing landscape.

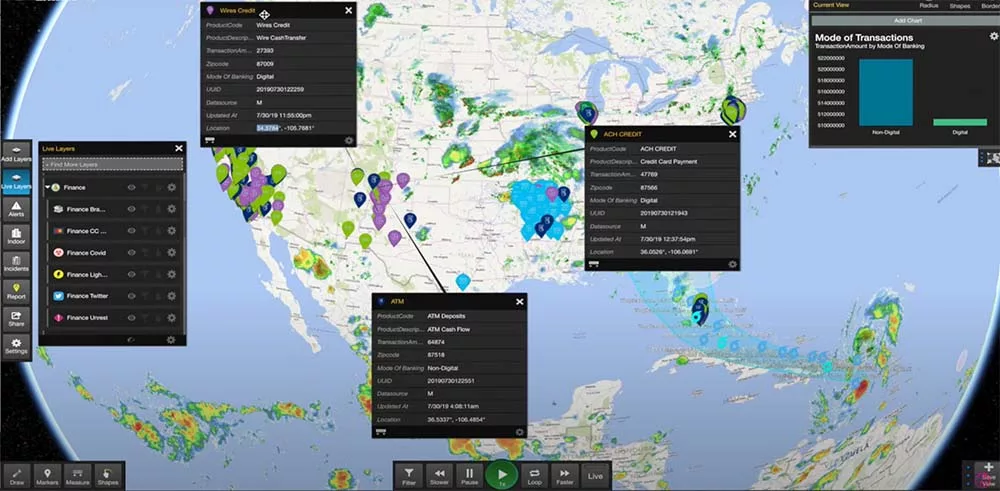

Of the many data solutions available to banks today, one that stands out is Live Earth. Live Earth’s real-time financial data platform is ideal for financial institutions trying to maximize revenue, mitigate risks, and identify growth opportunities — all from one centralized tool. The platform helps you make more informed business decisions based on insights from your data so you can stay ahead of the competition. Schedule your custom demo to see Live Earth in action and learn more about using data to improve customer loyalty.